Ericsson reported 2021Q2 results this morning. They posted a net profit attributable to shareholders of 3.68 billion kronor ($424.6 million) compared with SEK2.45 billion for the year-earlier period. Sales slipped 1.1% to SEK54.94 billion after sales in mainland China fell by SEK2.5 billion in the quarter.

If we ignore China, the story is quite good. Networks sales grew organically by 11%, despite lower volumes from delayed 5G deployment in Mainland China.

Börje Ekholm President and CEO said “it is prudent to forecast a materially lower market share in Mainland China for Networks and Digital Services as the earlier decision to exclude Chinese vendors from the Swedish 5G networks might influence market share awards.”

The market was surprised by Ericsson’s China related warning. At the time of writing of this article, the share prices were down 10% on Nasdaq.

More details on Ericsson’s results are here.

Past Ericsson results commentary are available here.

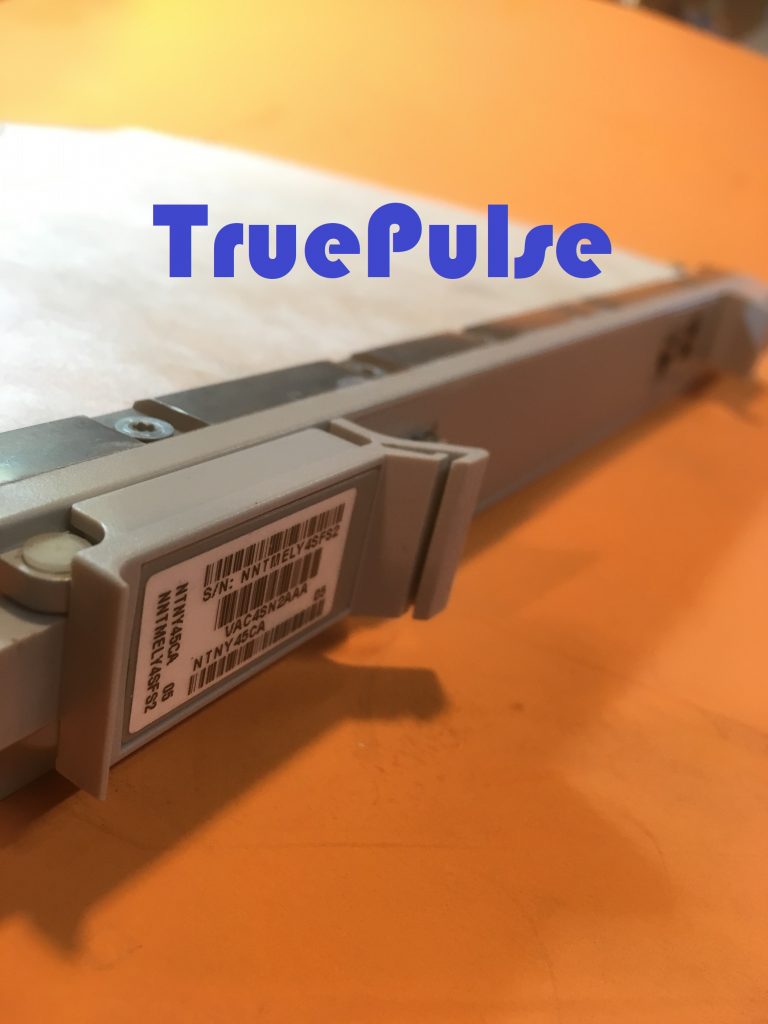

TruePulse buys and sells telecommunication equipment from Ericsson, as well as many other telco central office manufacturers including Lucent, Fujitsu and Ciena.

No Comment